In “Zero to One,” he aims to help readers find unique opportunities for progress in an already advanced business space, incorporating his optimistic view of future entrepreneurs’ ideas. Robert T. Kiyosaki is a millionaire businessman who grew up with two dads — his own, and his best friend’s father (the “rich dad”). In this business and finance book, Kiyosaki explains how his two dads shaped his view of money and investing and gives the readers advice on how to invest and grow their money. Malcolm Gladwell is a bestselling author best known for his nonfiction writing on psychology and sociology. In this psychology read, Gladwell analyses the “outliers” of the world — the best, the highest-achieving, the most famous people — to find what made them different and, thus, so successful.

- Bookkeeping involves the day-to-day recording of financial transactions, which includes documenting sales, expenses, payments, and receipts.

- And I observe the Jewish Sabbath, which means I don’t use smartphones or any electronic media from Friday at sundown until Saturday at sundown.

- Another type of accounting method is the accrual-based accounting method.

- “These can be avoided by maintaining meticulous records and using the right software,” Pierce says.

Have questions about small business accounting? Subscribe to Neat’s blog

With accurate bookkeeping, you can tell how much your business is making in terms of income and track your spending to ensure that you have enough cash on hand to cover your business expenses. Proper financial records make it easier for you to analyze the financial state of your firm and determine areas that need improvement. Similarly, you don’t notate outstanding bills until you actually pay them.

What you need to set up small business bookkeeping

Accounting can get more complex, especially as a small business becomes a big business. However, if you are not publicly traded or don’t have investors to keep happy, that list covers most of what you will see in a small business’ financial life. Larger organizations need to prepare financial statements in accordance with Generally Accepted Accounting Principles (GAAP) and are subject to regular audits. Then categorize your expenses into different categories, start estimating your expected revenue for the upcoming period, and allocate your expenses accordingly. If you go this route, make sure to brush up on interview questions that’ll help you determine who’s the best fit.

“The Fashion Business Manual: An Illustrated Guide to Building a Fashion Brand” by Fashionary

Consider using one of the best bookkeeping services to make managing your books a breeze. When manually doing the bookkeeping, debits are found on the left side of the ledger, and credits are found on the right side. Debits and credits should always equal each other so that the books are in balance. If you sell to customers on credit, you’ll tax calculator to estimate your tax refund and tax return need to send out invoices at a later date after providing your goods or services. And, determine invoice payment terms, such as forms of acceptable payment, when payments are due, where to send the payment, and late fees. Check with your banking institution to find out what documentation you need to provide to open a business bank account.

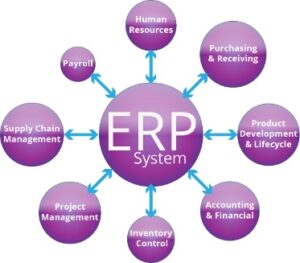

“Cash in” includes all the money paid to you by customers (and any Government grants for example), while “cash out” includes everything from supplier payments and staff salaries to utility bills and rent. Jami Gong is a Chartered Professional Account and Financial System Consultant. She holds a Masters Degree in Professional Accounting from the University of New South Wales. Her areas of expertise include accounting system and enterprise resource planning implementations, as well as accounting business process improvement and workflow design. Jami has collaborated with clients large and small in the technology, financial, and post-secondary fields.

It’s not just about money and power—those will only sustain us for so long. We need to find a work-life balance with time off, sleep, and mindfulness. That’s something “Thrive” argues for with a compelling certainty, backed up by the newest research in sports, psychology, and sleep.

It’s important to address any discrepancies promptly to maintain the accuracy of your financial data. It is essential to track and record all sources of income for your small business. Keep a record of all customer transactions, including sales receipts or invoices. Additionally, if you receive electronic payments, save the transaction details for your records. When considering different accounting software options, reading reviews from other small business owners can be helpful. These reviews can provide valuable insights into the strengths and weaknesses of each software, as well as real-life experiences from users.

First, you’ll have to expand your definition of the word “accounts.” In bookkeeping, accounts are categories like income, expenses, assets, liabilities, or equity. In this article, we’ll continue to use the term accounts for simplicity. Start by implementing these 13 bookkeeping and accounting fundamentals. This helps you understand the financial health and performance of your business. There is a lot more that goes into this, which is why you should collaborate with a certified accountant to make the most of your financial data.

This accounting method presumes that your most recent (last in) products will be the first to sell (first out). If your inventory costs fluctuate between the first and last items, this bookkeeping method helps keep the most accurate records possible. Single-entry accounting for product warranties bookkeeping is simpler — you only have to record each transaction once. This can be sufficient for very small businesses that aren’t incorporated. Records older than six years can be securely disposed of by hiring a professional document shredding company.

Through countless conversations with strangers and mentors I met in Jerusalem, I discovered so many opportunities I’d never even dreamed of. “Having as many conversations as possible with as many people as you can about your career aspirations will help you expand your ideas and bring to light options you may never have considered.” Carla Harris’s Strategize to Win speaks to anyone who’s contemplating a career change, which makes it invaluable for new entrepreneurs. She shows you how to attract the kinds of opportunities you want, first by clearly defining your goals and what you have to offer, then by building relationships and making changes as necessary. In the real world, the smartest people are people who make mistakes and learn.

If your profits and losses remain somewhat stable over a few years, you can get an idea of how much you’ll need to set aside each year for taxes, or how much you should be charging your customers for GST or HST. When creating the company’s balance how to make an invoice to get paid faster sheet, the FIFO method of valuation offers costs that most closely resemble the costs most recently incurred. So, which of these methods should you use in your bookkeeping to get the best, most accurate picture of your spending habits?

Bookkeeping programs that incorporate graphs, charts, and other visual aids make it easier to increase data precision and improve communication when you’re wooing investors. Accurate, up-to-date bookkeeping is the backbone of any successful small business. No matter what type of business you operate, an understanding of bookkeeping best practices is essential for keeping your business running smoothly, now and in the future. Your cash flow statement helps you understand how money moves into and out of your business.