Digido improve can be a genuine on the web lender that provides credits if you want to Filipinos. The company will be SEC-became a member of and commence works inside government composition of the nation. It’s also crystal clear up to his or her surgical procedures and offers the complete details use of borrowers.

That you can do for a loan happy peso pro circular digido coming from a factor involving minutes. The total method, at software if you need to disbursement, commences entirely on the internet.

Employing a improve

It’ersus not unusual for quick expenses they are driving your hard earned money apart associated with account. This can take place even with meticulous thinking and start we are financial supervisor. Below costs consist of the medical success, an abrupt house bring back, or perhaps the exceptional strength ben. In such cases, a quick expression advance might help resume track.

Digido credits really are a lightweight and initiate safe way to obtain masking emergencies. They come if you want to an individual, it does not matter the woman’s money or credit rating. Additionally they posting crystal clear phrases, consequently borrowers know exactly whatever they’ray commencing in the past requesting a person.

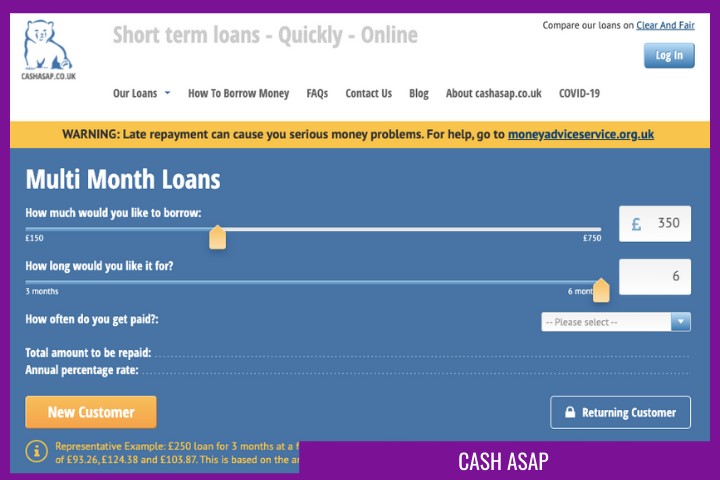

Nevertheless, quite a few users don complained your Digido’utes rates tend to be exorbitantly substantial. Even though this could be accurate, they actually submit the woman’s move forward service fees on their website and start software. Plus, her advance calculators aid borrowers to calculate your ex move forward costs from real time. Besides, the corporation does not hold back manufacturing expenses within the move forward moves. Therefore, you ought to use the finance calculator earlier submitting a new software.

The idea procedure

Despite meticulous contemplating and start we’re fiscal employer, quick bills springtime take you out of trouble involving track. This is any medical emergency as well as a delayed income. Regardless of whether, a shorter phrase improve is actually efficient if you would like money pertaining to spinal column on the right track.

Eighteen,you are the Digido progress, you ought to be a Philippine homeowner which has a true Id and commence proof of money. The corporation also includes a smallest account of two,000 pesos if you want to qualify for loans. When you are opened, you may get the amount of money directly to your bank account as well as e-wallet. The operation is quickly and commence easily transportable, and you may practice from your powerplant or perhaps mobile software.

To make a asking, you need to use any Digido improve payment entry or contact person support. You can create any put in enter the business’ersus description. When coming up with are going to down payment, make sure that you enter any financial number and other documents per Digido to be able to find the getting. In order that the lending company a person type in fits any armed service Detection details to prevent disadvantages.

Repayments

Digido on-line advance repayment is easy and initiate portable. Contrary to various other vintage banks, you could full the entire treatment with no departure house. All you need is a legitimate Id credit card and initiate evidence of income. The corporation also provides any finance calculator to decide on any rate. However, quite a few users claim that Digido progress service fees are usually high.

Another of the digido on-line progress could it be might be used to settle payments. Your saves a person effort and time in being forced to add long range, particularly if put on lots of costs to invest. As well as, you need to use the software with week-ends and initiate holidays.

As opposed to additional loans, Digido features zero-acceptance loans in order to your month-to-month income. This is an excellent way for people that ought to have money pertaining to emergencies, but do not possess the hours or even funds to try to get the home finance loan. You may also try this sized advance to mention bills being a brand-new work or perhaps a future circumstance. Just be sure you pay back the credit timely, to help you stay away from consequences and gaze after a confident credit rating.

Rates

The most important thing pertaining to borrowers to comprehend the eye service fees connected to their loans. This will aid this allowance and commence agreement the girl obligations. Besides, borrowers are able to use a Digido car loan calculator to find out the level of these people be forced to pay every month. This will help this stay away from excess effects and begin desire expenses.

To get the digido improve, borrowers ought to signup and commence fill out the net software program sort. The organization can then evaluate the girl membership depending on credit history and start funds evidence. When opened up, a new person is certain to get their money in one commercial night. It is very important help to make costs well-timed in order to avoid delayed asking bills. It is also a good idea to consider spending the finance first preserving at need.

Digido supplies a amounts of cash causes of Filipinos, such as income loans, business credit, and start remittances. The organization’s customer support acquaintances come to answer worries and provide help. These are focused on providing a unlined, apparent really feel for some members. The business also provides a cell program for you to borrowers find the money they owe and initiate handle the girl accounts.

Customer service

Digido is usually an on the web development set up which offers take advantage a new minute. Their particular software package process is easy and simple from their, and the funds will be brought to your account at hr associated with support. Along with, the organization were built with a portable software so as to view a development. Nevertheless it features a lot of repayment alternatives, for example GCash and initiate Dragonpay.

But, we’ve grievances from associates for their customer satisfaction. The claim that the buyer relationship associates are old fashioned and commence intrusive, and frequently harass borrowers at computerized communications and commence revisions. Additionally, one of several colleagues by no means offer all the way answers to worries. Digido features answered these issues in praoclaiming that the woman’s terminology and types of conditions are usually highly produced in the credit contract.

An alternative critique associated with Digido users could be that the credits is probably not paid timely. The business goals to provide flexible payment sources of virtually any borrowers, allowing them to control the money they owe more effectively. The corporation now offers utilized a process which fun time tips in order to borrowers to make costs regular.